Ottawa Real Estate Market Snapshot October 2018

Highlights from the Ottawa Real Estate Board's Latest News Release

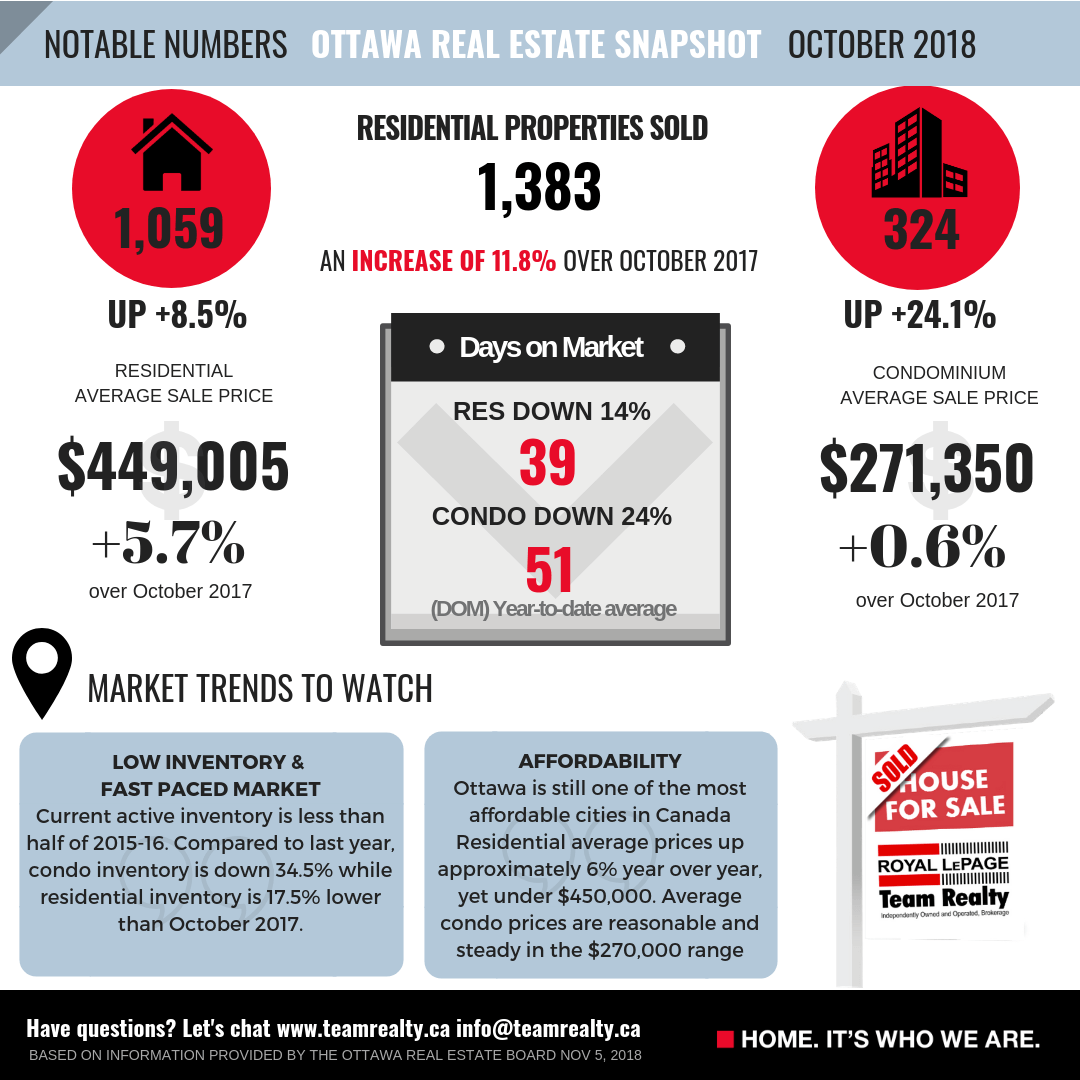

Halloween has not Scared Away Home Buyers

“October’s sales are truly indicative of the fast-paced market we have experienced for much of 2018,” points out Ottawa Real Estate Board President, Ralph Shaw. “In some pockets of the city, listings are not lingering on the market. Year-to-date average Days on Market (DOMs) are down 14% from 45 to 39 days for residential homes and 24% from 68 to 51 days for condominiums.”

“However, lack of supply continues to be a major driving factor in Ottawa’s real estate market,” he adds. “If we look back to 2015 and 2016, our current active inventory is less than half of what we had then, and it’s not improving. Compared to last year, condo inventory is down 34.5% while residential inventory is 17.5% lower than October 2017.”

“Ottawa’s reputation as one of the most affordable cities in the country endures with residential average prices up approximately 6% year over year, yet continuing to come in under $450,000. While average prices for condos remain reasonable and steady in the $270,000 range,” acknowledges Shaw.

“Further, the number of apartment condo projects that have been approved by the City of Ottawa will maintain price stability for this category of housing going forward. This will offer opportunities particularly for renters who may be considering homeownership since the rental inventory is also down 32% from this time last year.”

The $300,000 to $449,999 range remains the most active price point in the residential market, accounting for 43 per cent of home sales while the $500,000 to $750,000 price range continues to represent one in five of all residential home sales this past month. Between $175,000 to $274,999 was October’s most robust price point in the condominium market, accounting for almost 53 per cent of the units sold.

In addition to residential and condominium sales, OREB Members assisted clients with renting 2,354 properties since the beginning of the year.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.