Market Snapshot: Ottawa Real Estate December 2018

That's a wrap: Ottawa Real Estate Market December 2018!

As 2018 wrapped up, the inventory shortage has had a ripple effect; while residential sales were down slightly, it also fueled the condominium market. Overall, 2018 was another stellar year in Ottawa real estate! If you’re thinking of making a move in 2019, we know real estate. We’d love to chat!

Another Stellar Year for Ottawa’s Real Estate Market

(excerpts below were taken from the Ottawa Real Estate Board's news release January 4th)

January 4, 2019

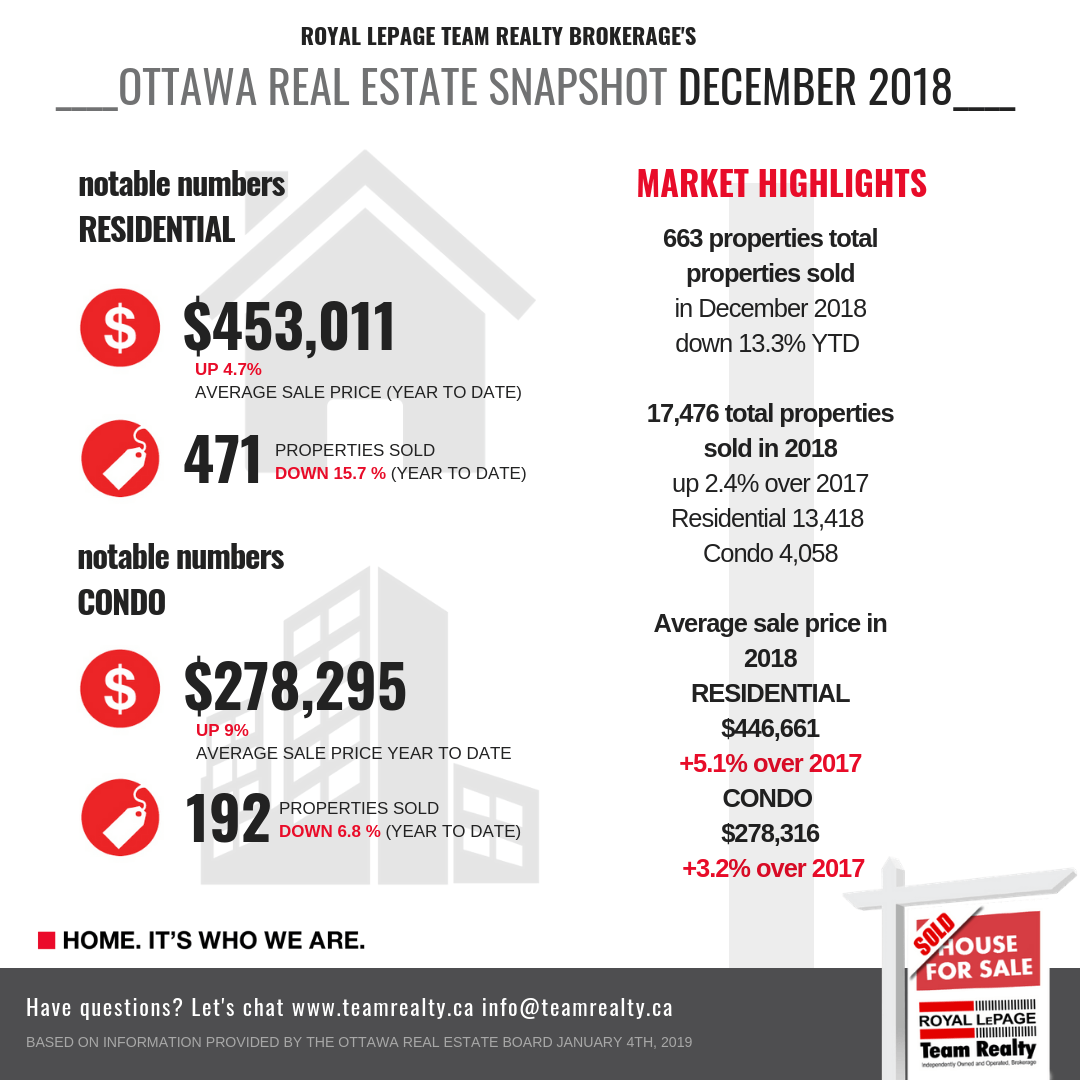

- 663 residential properties were sold by REALTORS® in the Ottawa Real Estate board compared with 765 in December 2017, a decrease of 13.3%

- Year to date activity increased by 2.4 % from 2017. The total number of residential and condo units sold throughout all of 2018 was 17,476, compared with 17,065 in 2017. Residential property class sales decreased slightly to 13,418 from 13,478 in 2017 and condominium property class sales were up 13.1 % with 4,058 units sold in 2018 versus 3,587 in the previous year.

- Most active Residential price point: $300,000 to $449,999 range accounted for nearly 45 % of December’s sales while almost one in four sales were in the $500,000 to $750,000 price range.

- Most active Condominium price point: $175,000 to $274,999 accounting for 55.7 % of the units sold.

- Year-end figures echoed these dominating price points holding 45.6 % of the residential market and 49.8 of the condo market respectively.

Highlights from the OREB president:

“For the last decade, we have experienced steady growth in our real estate market from volume to prices; however, the past two years have jumped significantly in activity with a 12.6% increase in unit sales from 2016. Ottawa, and its surrounding area has excellent employment numbers and has proven to be one of the most affordable larger cities in the country,” proclaims Ralph Shaw, Ottawa Real Estate Board’s 2018 President.

“What has come to a head in 2018 is the overall shortage of inventory which is extreme in certain pockets of the city. While this has caused unit sales to slide in the residential market, it has fueled the condominium market which has recovered and carried us through much of 2018. We have been predicting this will bode well for new construction in delayed high-rise projects,” he adds.

“Another significant factor affecting the market in 2018, and first-time homebuyers in particular, is the mortgage stress test – an attempt by the federal government to cool two major markets in the country. It has also unfortunately made move-up buyers less likely to take that step and free up entry-level options, which is an important part of the resale market,” Shaw points out.

“In 2019, we expect the economic fundamentals of supply and demand to be at play with upward pressure on prices due to limited supply and increasing demand. Buyers do have affordable options in outlying communities if they are willing to commute — or they will simply have to pay more provided they can qualify. New builds and purpose-built rental housing could help ease some of the pressure, particularly if builders are able to provide a variety of quality options allowing for more movement in the market,” Shaw concludes.

In addition to residential and condominium sales, OREB Members assisted clients with renting 2,713 properties since the beginning of the year down from 2,977 from this time last year.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.